ADA Price Prediction: Path to $1 Amid Technical Consolidation and Bullish Fundamentals

#ADA

- Technical Consolidation: ADA is trading below key moving averages but shows potential bullish divergence in MACD indicators

- Critical Support Level: The $0.80 price level serves as a crucial support zone that must hold for any significant upward movement

- Fundamental Catalysts: Cardano's 2025 DeFi roadmap and proposed liquidity fund provide strong long-term bullish fundamentals

ADA Price Prediction

ADA Technical Analysis: Key Levels to Watch

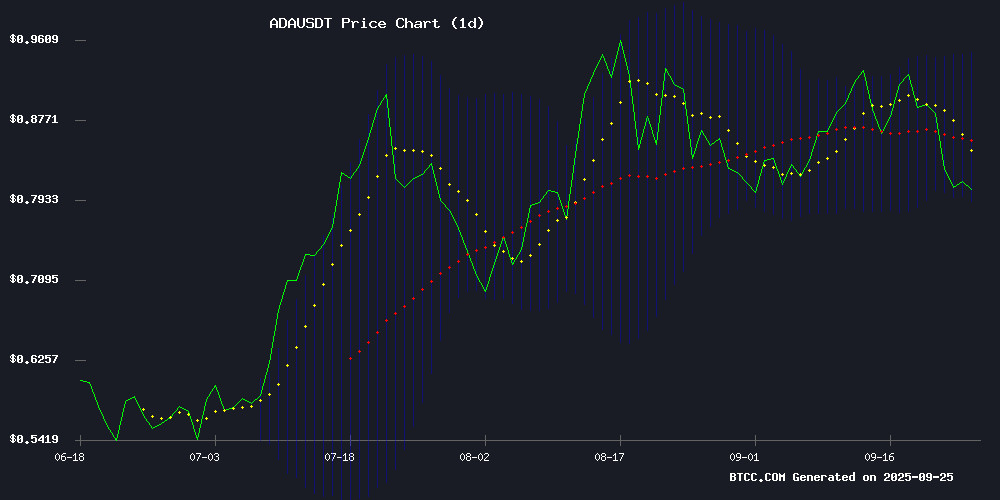

According to BTCC financial analyst Michael, ADA is currently trading at $0.7837, below its 20-day moving average of $0.8687. The MACD indicator shows a slight bullish divergence with the histogram at 0.01801, suggesting potential momentum building. However, ADA remains within the Bollinger Band range of $0.7866 to $0.9509, with the current price hovering NEAR the lower band.

Michael notes that maintaining support above $0.80 is crucial for any upward movement toward the $0.95 resistance level. The technical setup indicates consolidation with a slight bullish bias if key support levels hold.

Market Sentiment: Bullish Fundamentals vs Technical Pressure

BTCC financial analyst Michael observes that while recent Cardano developments are fundamentally positive, technical indicators suggest caution. The strategic DeFi and stablecoin roadmap for 2025, coupled with the proposed $50 million liquidity fund, creates strong long-term bullish sentiment.

However, Michael emphasizes that current technical levels must be respected. The break below key support amid declining trading volume indicates short-term pressure. The $0.80 level remains critical - maintaining this support could validate the bullish news-driven sentiment.

Factors Influencing ADA's Price

Cardano Bulls Eye Explosive $0.95 Break if $0.80 Maintains

Cardano trades at $0.796045, down 1.88% in 24 hours, with a market cap of $28.50 billion and daily volume of $1.62 billion. Analysts highlight $0.80 as critical support—holding this level could trigger a rebound toward $0.95 resistance, potentially confirming a bullish continuation.

Breakout scenarios project ambitious targets at $6.50, $9.50, and $12.15, though $1.10 remains a key hurdle. The token recently surged 490% before retracing to $0.82, with market participants interpreting the pullback as temporary. Crypto analyst Ali emphasizes Cardano's resilience at current levels, noting that sustained buyer activity near support could pave the way for upward momentum.

Cardano (ADA) Breaks Key Support Amid Declining Trading Volume

Cardano's ADA token fell below the critical $0.80 support level, trading at $0.79 with a 24-hour decline of 2.40%. The drop comes despite recent bullish news of Openbank's integration of ADA for its 2 million customers.

Technical indicators show bearish momentum, with the RSI at 38.73 approaching oversold territory. Derivatives volume plummeted 36% to $2.13 billion, while open interest dipped 1.6%, signaling reduced speculative activity.

Exchange outflows of $6.7 million on September 17 revealed profit-taking behavior, overshadowing the Openbank adoption news. Market sentiment appears cautious as liquidity wanes and traders retreat from ADA positions.

Cardano Unveils Strategic DeFi and Stablecoin Roadmap for 2025

Cardano (ADA) is making bold moves to cement its position in decentralized finance, with the Cardano Foundation announcing a multi-million ADA budget to fuel stablecoin adoption and DeFi liquidity. The initiative, dubbed the Stablecoin DeFi Liquidity Budget, aims to streamline transactions and deepen liquidity pools, positioning the network as a competitive smart contract platform.

Governance takes center stage with 220 million ADA allocated to Delegated Representatives (DReps), empowering community-led decision-making. This dual focus on financial infrastructure and participatory governance signals Cardano's ambition to blend technological innovation with real-world utility.

Cardano Price Prediction: Analysts Target $12.156 Amid Consolidation

Cardano's ADA recently surged 490% before settling near $0.82, a pause that analysts interpret as consolidation ahead of another potential rally. Technical charts reveal a tightening wedge pattern, with key moving averages acting as support—a bullish signal for traders.

Cryptorecruit's analysis highlights a breakout target of $12.15, backed by Fibonacci extensions pointing to $6.50 and $9.50 as interim milestones. Such a move could propel Cardano's market cap into the $197-$291 billion range, rivaling top cryptocurrencies.

Immediate resistance lies at $1.10. A decisive close above this level may confirm renewed upward momentum, validating the bullish thesis that views the current phase as accumulation rather than stagnation.

Cardano Foundation Proposes $50 Million Liquidity Fund to Boost Stablecoin and DeFi Adoption

The Cardano Foundation has unveiled a strategic roadmap to inject 50 million ADA (approximately $40.5 million) into a liquidity fund aimed at accelerating stablecoin adoption and decentralized finance (DeFi) activity on its blockchain. The initiative targets one of the ecosystem's most pressing challenges—liquidity depth—while positioning Cardano for sustainable growth.

Stablecoins are framed as a catalyst for broader network adoption, with the Foundation projecting a 4% annual return for its treasury through increased trading volumes and total value locked (TVL). Revenue distribution will follow an 85/15 split—the majority reinvested to compound protocol growth, the remainder converted monthly to ADA.

This liquidity push anchors Cardano's eighth-anniversary roadmap, which also includes scaling Web3 adoption teams. Priorities span exchange integrations, tokenized asset partnerships, and enterprise use cases—a multi-pronged approach to solidify Cardano's position in the competitive smart contract landscape.

Will ADA Price Hit 1?

Based on current technical and fundamental analysis, BTCC financial analyst Michael provides the following assessment for ADA reaching $1:

| Factor | Current Status | Impact on $1 Target |

|---|---|---|

| Price Position vs MA | Below 20-day MA ($0.8687) | Negative short-term |

| Bollinger Band Position | Near lower band ($0.7866) | Potential rebound opportunity |

| MACD Signal | Slightly bullish divergence | Moderately positive |

| Key Support Level | $0.80 critical | Must hold for upward move |

| Fundamental News | Strong DeFi roadmap | Long-term positive |

Michael concludes that while $1 is achievable in the medium term, ADA must first reclaim the $0.95 resistance level and maintain above $0.80 support. The combination of strong fundamentals and current technical consolidation suggests a gradual path toward $1, likely requiring several weeks of sustained bullish momentum.